Local investors participate in GameStop craze

Robinhood restrictions cost Cal students big money

The GameStop short squeeze caused a lot of controversy in the stock market and cost some Cal High students money.

Thousands of Reddit users, including Cal High students, united online in mid-January to buy millions of shares of poorly-performing companies such as Gamestop, AMC, and Blackberry.

These stocks were shorted by hedge funds and other rich investors in an effort to take advantage of the companies’ poor financial performance. Shorting is when investors bet that a stock’s price will decrease. Investors short stocks with the expectation that they will make money.

A short squeeze is when some investors are forced to sell their short positions in a stock that is rising rapidly to avoid big losses. In other words, short-sellers are ‘squeezed’ out of the market.

The Redditors’ short squeeze caused Gamestop’s trade price to soar, starting around $20 and peaking at $347.51, while AMC started around $2 and hit $19.90 before plummeting again.

Sophomore Darren Murphy, who spends an average of two hours a day researching and trading stocks, caught wind of the squeeze.

“I heard about it early and got in as a joke,” Murphy said. “But when it skyrocketed the way it did I was kind of nervous.”

Those who invested in the stocks early cashed in until Robinhood, a stock brokerage commonly used by younger investors, made immediate calls to suspend the ability to trade 13 different stocks, including Gamestop (GME) and AMC.

Investors were outraged as the announcement not only restricted Robinhood users from taking part in the squeeze.With news of a big player like Robinhood out of the game, the stock quickly collapsed.

“It’s a free market so everyone should be able to trade what they want when they want,” Murphy said. “Brokers like Robinhood denying that is kind of ruining the point of an open market for the average investor.”

Senior Johnathon Larkin, an investor who watches the market from 5:30 a.m. to 1 p.m., explained how drastically the stock exchange can affect even the most avid investors.

“I made around $1.4k on GME but permanently lost $2k in AMC,” Larkin said. “At one point I was down a total of $6.5k and that was nothing compared to what others lost.”

Larkin went on to explain that Robinhood completely mishandled the situation and still hasn’t given equitable reasoning as to why they closed trading to those select 13 companies.

Sophomore Preston Trager, who also regularly invests, witnessed how Robinhood’s actions affected people he knew.

“I had a friend who had contracts on AMC and he was up two grand at [one] point,” Trager said, “He wasn’t able to sell because they stopped him.”

Although Trager’s friend was able to profit about $200, Robinhood’s restrictions cost him the opportunity to triple his profile.

Investors took to social media to express their anger even going as far as to boycott the brokerage. Many feel that it was fair to manipulate the market as people should be able to make money however they please as long as they don’t break the law.

“I think they found a grey area and took advantage of that grey area,” Trager said. “For when it happened and how it happened it was completely fair.”

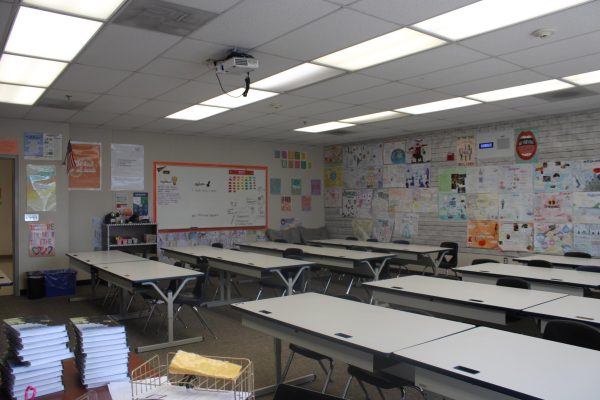

Even with the large profits made on these companies, economics teacher Sarah Eddings has some reservations when it comes to investing too young.

“It gets really scary if there aren’t limits in place to protect novice users from making huge mistakes,” Eddings said.

Eddings said many people may think investing may be more of a gamble than a reliable way to make money due to such volatile stocks.

After observing what happened with Gamestop and other stocks in January, Eddings believes the power play involved with the short squeeze was a big turning point in the market.

“My students found it incredibly inspiring,” Eddings said. “It made them feel like regular people had power.”

Senior Saachi Sharma is the editor of the premiering Podcast section this year. This is her third year in Newspaper and she is very excited to transition...